AMC's Stock Split Saga: A Rollercoaster Ride

AMC Entertainment Holdings, Inc. (AMC) has made headlines not just for its movie offerings, but also for its dramatic stock split history. The company's recent maneuvers, including a 1:10 split followed by a 1:1.1 split in August 2023, have sparked intense debate among investors. Was this a stroke of genius, a desperate gamble, or something else entirely? To understand the long-term implications, we must delve into AMC's past stock split decisions and analyze the market's response. This article examines AMC's stock split history, dissecting the motivations, market reactions, and potential future consequences for shareholders and the company itself. The question remains: Did these splits truly benefit AMC, or were they ultimately a risky maneuver with uncertain outcomes?

The stated primary goal of AMC's recent splits was to enhance stock liquidity. By dramatically increasing the number of outstanding shares, the price per share falls, making the stock more accessible to retail investors. The underlying theory suggests that increased trading activity, fueled by a wider investor base, could drive the price back up over time. However, the reality is considerably more nuanced. Immediate post-split price action is often volatile and heavily influenced by broader market sentiment and investor speculation. While AMC may have achieved increased trading volume, the long-term impact on shareholder value is far from certain.

To gain a comprehensive understanding, we need to consider AMC's complete stock split history, though detailed information on this is somewhat limited in easily accessible public sources. By analyzing past splits and their subsequent market performance, along with AMC’s financial condition at each stage, a more complete picture emerges. But even with a complete historical review, it's crucial to remember that stock splits don't magically improve a company's underlying financial health.

Examining the Impact: Short-Term Volatility and Long-Term Uncertainty

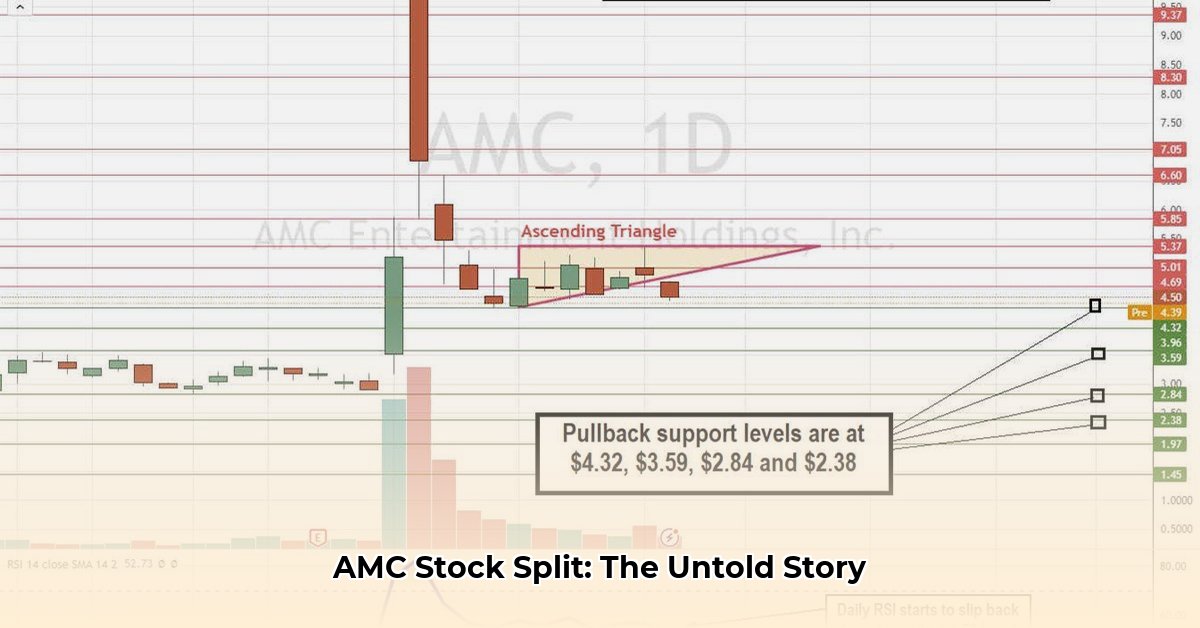

The immediate aftermath of AMC's August 2023 splits showcased the inherent volatility of such actions. Share prices experienced dramatic fluctuations, highlighting the influence of investor sentiment and speculation. Did the splits signal renewed confidence in AMC's future, or did they reinforce concerns about the company's financial stability? The answer, unfortunately, isn't clear-cut and depends heavily on individual investor interpretations.

But what about the long-term outlook? The pivotal question regarding the long-term impact revolves around AMC's subsequent financial performance. A stock split, regardless of its type, doesn't inherently improve a company's financial fundamentals. It's a structural change, not a financial cure-all. Therefore, the success of AMC's stock splits will be determined by its ability to improve its overall financial health, its innovation in the face of industry headwinds, and ultimately, the market's reassessment of its long-term value proposition.

It’s important to note that a multitude of factors influence stock prices beyond stock splits. Macroeconomic conditions, industry trends (particularly the continued rise of streaming services), AMC's debt load, and management decisions are all significant contributors to the company's overall valuation.

Who Won, Who Lost? Analyzing the Impact on Key Stakeholders

To provide context and an objective view, let’s assess the potential impacts on different stakeholder groups:

| Stakeholder | Potential Short-Term Impact | Potential Long-Term Impact |

|---|---|---|

| AMC Management | Increased trading volume; potentially higher stock price (short-term) | Dependent on AMC's financial performance and market adaptation |

| Retail Investors | Increased accessibility to AMC stock | Gains or losses depending on overall AMC performance |

| Institutional Investors | Dilution of ownership stake; increased trading opportunities | Re-evaluation of investment based on AMC's future and market conditions |

This table demonstrates that while AMC management might experience a perceived short-term benefit from increased trading volume and a potential temporary stock price boost, the long-term effects—for all stakeholders—remain contingent on various factors, all of which are ultimately beyond the direct control of a stock split. Did the stock splits enhance long-term shareholder value? Only time will provide a definitive answer.

Navigating the Future: Risk Assessment and Actionable Insights

AMC's stock split history is a case study in the complexities of financial maneuvering. While increasing liquidity might provide short-term advantages, the overall success or failure hinges on AMC's ability to address its underlying financial challenges and adapt to the rapidly evolving entertainment industry. The risks are considerable, and the long-term implications remain highly uncertain. What will the next chapter of AMC's story reveal?

Key Takeaways:

- No Guarantee of Success: Stock splits do not guarantee increased long-term shareholder value.

- Underlying Performance Matters: Success hinges on AMC's overall financial performance and adaptation to industry changes.

- Market Sentiment is Key: Immediate post-split reactions are heavily influenced by investor sentiment and speculation.

- Long-Term Outlook Remains Uncertain: Only time will tell the full impact of AMC's stock split strategy.

This detailed analysis provides a comprehensive view of AMC's stock split history, offering insights into the motivations, consequences, and future outlook for the company and its investors. The narrative approach helps readers understand the complexities of the situation and provides a balanced assessment of the potential long-term impacts.